Why This Slide Is Useful

This slide is valuable for senior executives, asset managers, and strategic consultants focused on CRE portfolio optimization. It consolidates critical metrics that influence investment decisions, operational strategies, and valuation assessments. By understanding these KPIs, leaders can identify underperforming assets, benchmark against industry standards, and prioritize initiatives to maximize returns.

The inclusion of definitions and importance clarifies why each metric matters, enabling more informed discussions with stakeholders and investment committees. The benchmarking data offers a quick reference point to assess whether assets are performing within expected ranges or require intervention. This makes the slide a practical tool for ongoing portfolio review and strategic planning.

For management teams, this slide supports data-driven decision-making. It helps translate raw financial and operational data into actionable insights. Asset managers can use it to communicate performance status during board meetings or investor updates, ensuring alignment on strategic priorities.

Consultants and analysts benefit from the structured format, which facilitates rapid diagnostics of asset health. They can leverage the KPIs to develop targeted recommendations for value enhancement, risk mitigation, or portfolio rebalancing. The slide’s clarity and focus make it suitable for both tactical assessments and high-level strategic discussions.

How This Slide Is Used

This slide is typically used in portfolio review sessions, investment committee meetings, or asset management workshops. It serves as a reference point for evaluating individual assets or entire portfolios against industry benchmarks. Asset managers and senior leaders rely on it to identify performance gaps or areas for operational improvement.

In practice, the slide is often customized with specific asset data or regional benchmarks. For example, a portfolio review might highlight assets with vacancy rates above the benchmark range, prompting targeted leasing strategies. Similarly, during due diligence, analysts use these KPIs to compare prospective acquisitions against established standards.

Consultants frequently incorporate this slide into client presentations to demonstrate asset performance trends or to support strategic recommendations. It provides a clear, visual summary that can be easily communicated to non-technical stakeholders, such as investors or board members.

Additionally, the slide supports ongoing monitoring and reporting. Asset managers may update the benchmarks periodically to reflect market shifts or new data, ensuring that performance assessments remain relevant. It also functions as a foundation for developing dashboards or scorecards that track portfolio health over time.

Related PPT Slides

This slide displays the monthly support metrics for various IT assets, including desktops, laptops, servers, and storage devices. It tracks the status, counts, and changes over time, providing a snapshot of support activity and infrastructure stability. The visual cues and annotations help identify trends and areas requiring attention for IT operations management.

This slide presents a SWOT analysis focused on the commercial real estate (CRE) sector, highlighting key strengths, weaknesses, opportunities, and threats. It provides a structured snapshot of the sector's internal and external factors influencing asset performance, tailored for strategic decision-making by executives and investors.

AgriTech KPIs for Crop Yield, Emissions, and Regulatory Timelin

This slide outlines key performance indicators (KPIs) relevant to AgriTech, focusing on crop yield improvements, emissions reduction, and regulatory approval timelines. It provides clear definitions, importance, and benchmark targets for each KPI, serving as a strategic measurement framework for operational and strategic decision-making in the sector.

This slide displays a five-year financial projection, including benefits, investments, costs, and net cash flow. It organizes data across multiple categories with annual breakdowns, providing a comprehensive view of expected financial performance. The layout supports quick assessment of project viability and key financial metrics for decision-makers.

Balanced Scorecard Linking Measures

This slide illustrates how the Balanced Scorecard connects key performance indicators across 4 perspectives to demonstrate their impact on financial and operational outcomes. It visualizes the cause-and-effect relationships between customer satisfaction, employee morale, internal processes, and financial results, emphasizing the integrated nature of strategic measurement.

Priority Salvage Lists for Business Disruption

This slide outlines a structured template for documenting critical assets during business recovery efforts. It emphasizes the importance of categorizing assets by unit, location, and comments, providing a clear framework for prioritizing resources in case of disruption. The layout facilitates quick reference and comprehensive asset management for recovery planning.

Explore Slides by Tags

View Full Commercial Real Estate (CRE) PPT

Download our FREE collection of over 50+ high-impact, fully editable PowerPoint templates. These professional templates cover a comprehensive range of strategic analysis frameworks—including Strategy Formulation, Innovation, Digital Transformation, Change Management, and many others—ideal for Management Consultants, Investment Bankers, Strategy Professionals, and Business Executives.

Trusted by Leading Global Organizations

Our templates are trusted by thousands of organizations worldwide, including leading brands such as those listed below.

Related Templates from PPT Depot

Leverage our domain and design expertise. Become a subscriber today:

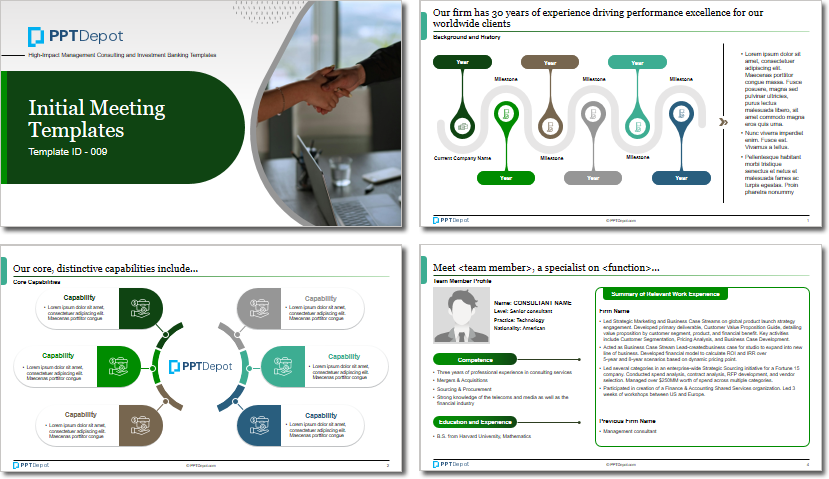

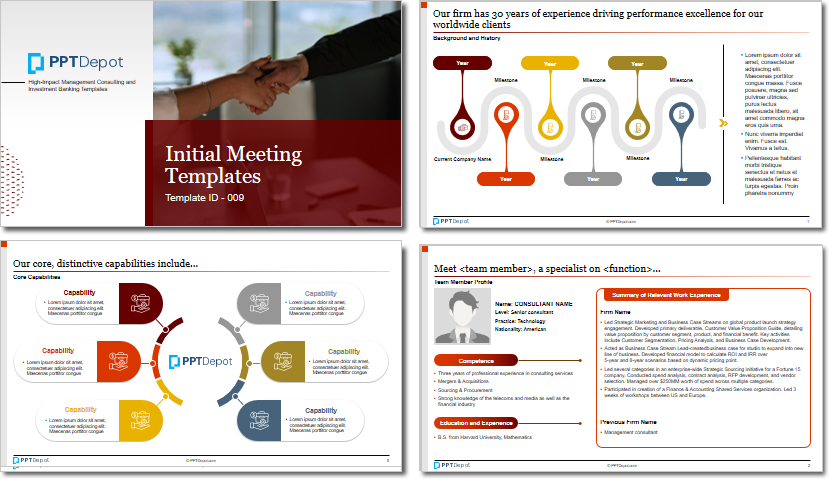

Each presentation is available in 3 color schemes. Download the version that most fits your firm's branding and customize it further once you download the PPTX file.

PPT Depot is your subscription to high-impact management consulting and investment banking templates—crafted from real-world deliverables by ex-MBB consultants and designed by former McKinsey Visual Graphics (VGI) presentation specialists. Compare plans here to determine what's the best fit for your firm.

With 15 years of experience, the team behind PPT Depot has empowered over 500+ clients across over 30+ countries. We currently produce 200,000 slides annually.

PPT Depot releases new templates each week. We have management topic-focused templates (e.g. market analysis, strategic planning, digital transformation, and more), alongside industry-specific collections. Peruse our full inventory here.

Save time and effort—elevate your presentations with proven domain and design expertise.

Got a question? Email us at [email protected].

Related Consulting Presentations

These presentations below are available for individual purchase from Flevy , the marketplace for business best practices.

Slide Customization & Production

We provide tailored slide customization and production services:

- Conversion of scanned notes into PowerPoint slides

- Development of PowerPoint master template

- Creation of data-driven PowerPoint charts from hand-drawn graphs

- Conversion of Excel charts to PowerPoint charts

- Conversion of other file formats (e.g. PDF, TIF, Word Doc) to PowerPoint slides

- Conversion of PowerPoint slides from one master template to another

- Visual enhancement of existing PowerPoint presentations to increase the professional look of the presentation