Why This Slide Is Useful

This slide is valuable for senior executives and strategists seeking to understand the critical components that underpin AI industry profitability. It clarifies how foundational support activities—like data acquisition, R&D, infrastructure, and talent—are essential to sustain primary AI functions and ultimately drive margins. This perspective helps leaders identify where to allocate resources or focus innovation efforts to maximize value creation within the AI industry.

For management consultants advising clients on AI strategy, this slide offers a structured overview of the entire ecosystem. It enables quick diagnosis of potential bottlenecks or gaps in a client’s AI value chain, whether in talent, infrastructure, or regulatory advocacy. This understanding facilitates targeted recommendations for strengthening competitive positioning or accelerating AI deployment.

Investment professionals, particularly those involved in AI-focused ventures or portfolio companies, use this slide to assess where value is generated and margins are captured. It highlights the importance of supporting activities that can be optimized or scaled to improve overall profitability. The visual also helps in framing discussions around strategic investments or partnerships in specific segments of the AI ecosystem.

In operational contexts, this slide supports planning for AI product development or service delivery. It clarifies the sequence of activities from data collection to end-user support, guiding project prioritization and resource allocation. By mapping primary and support activities, organizations can better align their capabilities with strategic objectives and market demands.

How This Slide Is Used

This slide is typically used during strategic planning sessions, industry analysis, or investor presentations focused on AI. It serves as a reference point for understanding how different activities contribute to the overall value chain and margin generation. Leaders and consultants leverage it to communicate the complexity and interconnectedness of AI development and deployment.

In client engagements, this slide often functions as a diagnostic tool to identify gaps or weaknesses in a company’s AI ecosystem. For example, if a client struggles with talent acquisition or regulatory advocacy, this visual helps pinpoint where to focus improvement efforts. It also supports scenario planning around scaling AI capabilities or entering new markets.

For technology companies and startups, this slide guides product roadmaps by emphasizing the importance of supporting activities like hardware production or software deployment. It helps teams prioritize investments in infrastructure, talent, or compliance to accelerate primary activities and improve margins.

Additionally, the slide is used in discussions with investors or partners to illustrate the end-to-end nature of AI value creation. It provides a clear framework for explaining how investments in specific activities translate into competitive advantage and financial returns. This comprehensive view supports strategic alignment across stakeholders involved in AI initiatives.

Related PPT Slides

This slide illustrates the core components of the EdTech value chain, highlighting primary activities like content development, platform delivery, marketing, and user engagement. It also emphasizes support activities such as technology R&D, data management, infrastructure, regulatory navigation, and talent acquisition, all contributing to the overall margin. The visual structure helps clarify how each activity adds value and supports the end-to-end process in the EdTech sector.

This slide illustrates the comprehensive value chain within the FinTech industry, emphasizing the core activities from product development to regulatory compliance. It highlights how support functions like data management and R&D innovation underpin primary activities such as customer acquisition and service delivery, all aligned toward margin generation. The visual structure aids in understanding the interconnectedness of these components for strategic analysis.

This slide depicts the core activities and support functions within the mining industry, illustrating how value is generated from exploration through sales and trading. It emphasizes the importance of both primary operations and supporting activities, highlighting the flow of value creation and margin accumulation across the chain. The visual layout aids in understanding the interconnectedness of each stage and its contribution to overall profitability.

This slide illustrates Michael Porter's Value Chain framework, which dissects an organization’s activities into primary and support functions to identify sources of value creation and cost advantage. It categorizes activities such as inbound logistics, operations, outbound logistics, marketing, and service, alongside support activities like firm infrastructure and human resource management, emphasizing their role in generating margin.

This slide outlines a structured four-step methodology for conducting value chain analysis. It emphasizes identifying industry-specific activities, assigning costs and revenues, determining cost drivers, and pinpointing competitive advantages through cost control or value chain reconfiguration. The visual format supports clarity for strategic decision-making discussions.

Value Chain Transformation Evolution

This slide illustrates how the value chain evolves through different stages of transformation, emphasizing the shift in core activities and margins. It visually compares the initial and subsequent states of the value chain, highlighting key components such as logistics, operations, and marketing, alongside their impact on profit margins. The layout supports strategic discussions around optimizing or reconfiguring the value chain for competitive advantage.

Explore Slides by Tags

View Full Artificial Intelligence PPT

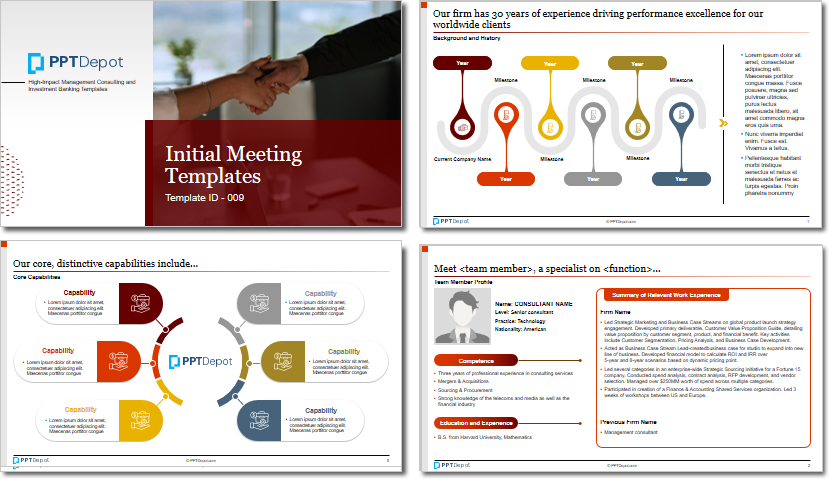

Download our FREE collection of over 50+ high-impact, fully editable PowerPoint templates. These professional templates cover a comprehensive range of strategic analysis frameworks—including Strategy Formulation, Innovation, Digital Transformation, Change Management, and many others—ideal for Management Consultants, Investment Bankers, Strategy Professionals, and Business Executives.

Trusted by Leading Global Organizations

Our templates are trusted by thousands of organizations worldwide, including leading brands such as those listed below.

Related Templates from PPT Depot

Leverage our domain and design expertise. Become a subscriber today:

Each presentation is available in 3 color schemes. Download the version that most fits your firm's branding and customize it further once you download the PPTX file.

PPT Depot is your subscription to high-impact management consulting and investment banking templates—crafted from real-world deliverables by ex-MBB consultants and designed by former McKinsey Visual Graphics (VGI) presentation specialists. Compare plans here to determine what's the best fit for your firm.

With 15 years of experience, the team behind PPT Depot has empowered over 500+ clients across over 30+ countries. We currently produce 200,000 slides annually.

PPT Depot releases new templates each week. We have management topic-focused templates (e.g. market analysis, strategic planning, digital transformation, and more), alongside industry-specific collections. Peruse our full inventory here.

Save time and effort—elevate your presentations with proven domain and design expertise.

Got a question? Email us at [email protected].

Related Consulting Presentations

These presentations below are available for individual purchase from Flevy , the marketplace for business best practices.

Slide Customization & Production

We provide tailored slide customization and production services:

- Conversion of scanned notes into PowerPoint slides

- Development of PowerPoint master template

- Creation of data-driven PowerPoint charts from hand-drawn graphs

- Conversion of Excel charts to PowerPoint charts

- Conversion of other file formats (e.g. PDF, TIF, Word Doc) to PowerPoint slides

- Conversion of PowerPoint slides from one master template to another

- Visual enhancement of existing PowerPoint presentations to increase the professional look of the presentation