Why This Slide Is Useful

This slide is valuable because it provides a structured approach for investors and management teams to evaluate company performance through a clear set of metrics. It emphasizes the importance of aligning financial data with strategic objectives, enabling better decision-making and resource allocation. For C-level executives and PE professionals, this framework helps communicate value creation pathways to stakeholders, including boards and investors, with clarity and precision.

The slide’s focus on contrasting strategic options with performance frameworks offers a comprehensive view of how operational metrics translate into investment insights. It highlights the need for both qualitative and quantitative measures—such as internal performance contracts and non-financial indicators—to capture the full scope of company health. This dual perspective supports more nuanced assessments during due diligence or ongoing portfolio management.

Furthermore, the emphasis on information disclosures underscores the importance of transparency in investor relations. By visualizing the flow from strategic choices to performance metrics, the slide aids in crafting compelling narratives around value drivers. It also serves as a diagnostic tool to identify gaps in measurement systems or reporting practices, which can be critical in restructuring or turnaround scenarios.

Overall, this slide acts as a blueprint for integrating strategic management with investor reporting. It aligns operational performance with financial outcomes, facilitating more informed discussions with stakeholders and supporting strategic pivots or growth initiatives.

How This Slide Is Used

This slide is typically used during investment committee meetings, portfolio reviews, or strategic planning sessions. PE firms and corporate development teams leverage it to establish a common language around performance metrics and strategic priorities. It helps frame discussions around where value is being created and where improvements are needed.

In due diligence processes, the slide guides the assessment of target companies by highlighting relevant financial and non-financial metrics. Investors use it to compare potential investments or monitor post-acquisition performance against predefined benchmarks. The visual layout makes it easier to communicate complex measurement systems to diverse audiences, including board members and operational managers.

Management consultants often customize this framework for clients by adding specific asset classes or strategy elements relevant to the industry or company. For example, they might incorporate ESG metrics or digital transformation indicators within the internal measures. This customization ensures the scorecard remains aligned with strategic priorities and stakeholder expectations.

In ongoing portfolio management, the slide supports tracking progress over time. It can be integrated into dashboards or reporting templates to visualize how strategic choices influence performance outcomes. This enables proactive adjustments and targeted interventions, especially in dynamic or turnaround situations, where clear measurement is critical for success.

Related PPT Slides

This slide displays a comparative analysis of actual versus target performance across multiple categories. It combines a bar chart and a line graph to illustrate the gap between current results and strategic objectives, providing a visual snapshot of performance trends and variances.

Balanced Scorecard Linking Measures

This slide illustrates how the Balanced Scorecard connects key performance indicators across 4 perspectives to demonstrate their impact on financial and operational outcomes. It visualizes the cause-and-effect relationships between customer satisfaction, employee morale, internal processes, and financial results, emphasizing the integrated nature of strategic measurement.

Healthcare Metrics Dashboard Overview

This slide displays key performance indicators (KPIs) used to monitor clinical, financial, and innovation metrics within healthcare providers. It outlines each KPI's definition, its significance, and relevant benchmarks, offering a comprehensive view of performance measurement in the healthcare sector. The visual layout emphasizes clarity and quick reference for executive decision-making.

Actual vs. Target Comparison Chart

This slide displays a side-by-side comparison of actual performance metrics against target benchmarks across 4 categories. It uses circular progress indicators with percentage values to visually emphasize the gaps or alignments between current and desired states, facilitating quick assessment for decision-makers.

AgriTech KPIs for Crop Yield, Emissions, and Regulatory Timelin

This slide outlines key performance indicators (KPIs) relevant to AgriTech, focusing on crop yield improvements, emissions reduction, and regulatory approval timelines. It provides clear definitions, importance, and benchmark targets for each KPI, serving as a strategic measurement framework for operational and strategic decision-making in the sector.

Strategy Map and Performance Alignment

This slide illustrates how a strategy map visually links an organization’s mission, vision, values, and strategic plan to measurable outcomes. It emphasizes translating strategic intent into specific targets and initiatives, culminating in performance metrics that align across all levels of the organization. The visual structure supports clarity in strategic communication and execution.

Explore Slides by Tags

View Full Performance Management PPT

Download our FREE collection of over 50+ high-impact, fully editable PowerPoint templates. These professional templates cover a comprehensive range of strategic analysis frameworks—including Strategy Formulation, Innovation, Digital Transformation, Change Management, and many others—ideal for Management Consultants, Investment Bankers, Strategy Professionals, and Business Executives.

Trusted by Leading Global Organizations

Our templates are trusted by thousands of organizations worldwide, including leading brands such as those listed below.

Related Templates from PPT Depot

Leverage our domain and design expertise. Become a subscriber today:

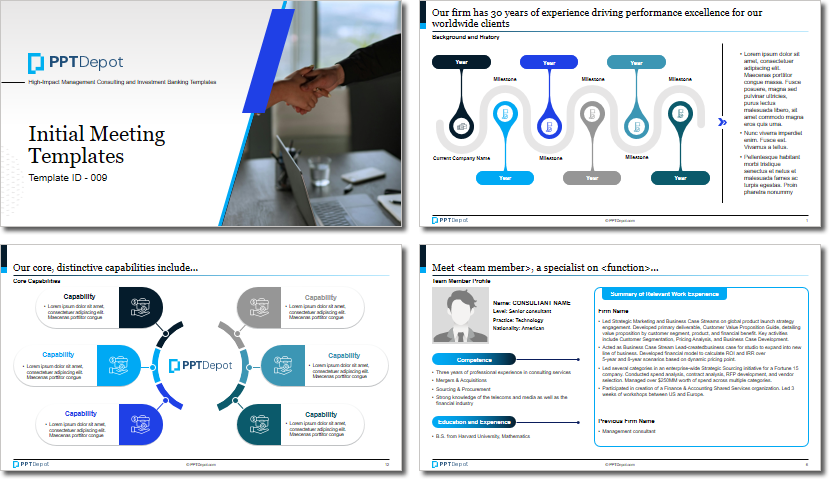

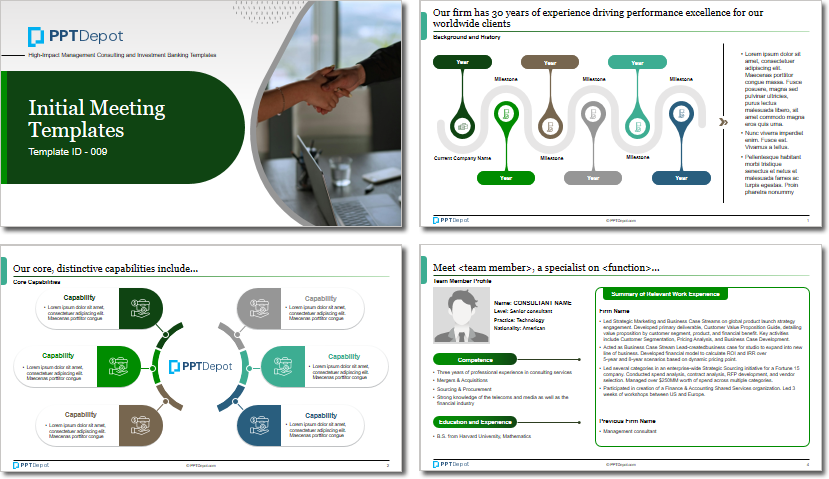

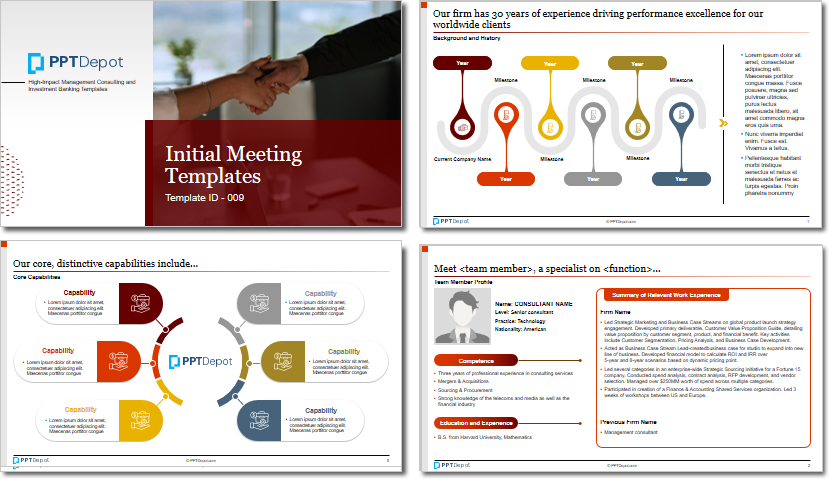

Each presentation is available in 3 color schemes. Download the version that most fits your firm's branding and customize it further once you download the PPTX file.

PPT Depot is your subscription to high-impact management consulting and investment banking templates—crafted from real-world deliverables by ex-MBB consultants and designed by former McKinsey Visual Graphics (VGI) presentation specialists. Compare plans here to determine what's the best fit for your firm.

With 15 years of experience, the team behind PPT Depot has empowered over 500+ clients across over 30+ countries. We currently produce 200,000 slides annually.

PPT Depot releases new templates each week. We have management topic-focused templates (e.g. market analysis, strategic planning, digital transformation, and more), alongside industry-specific collections. Peruse our full inventory here.

Save time and effort—elevate your presentations with proven domain and design expertise.

Got a question? Email us at [email protected].

Related Consulting Presentations

These presentations below are available for individual purchase from Flevy , the marketplace for business best practices.

Slide Customization & Production

We provide tailored slide customization and production services:

- Conversion of scanned notes into PowerPoint slides

- Development of PowerPoint master template

- Creation of data-driven PowerPoint charts from hand-drawn graphs

- Conversion of Excel charts to PowerPoint charts

- Conversion of other file formats (e.g. PDF, TIF, Word Doc) to PowerPoint slides

- Conversion of PowerPoint slides from one master template to another

- Visual enhancement of existing PowerPoint presentations to increase the professional look of the presentation