Why This Slide Is Useful

This slide is useful because it provides a comprehensive view of how value is created in the CRE sector, emphasizing the importance of both primary activities and support functions. For management consultants and investment professionals, it offers a clear framework to identify key leverage points across the industry’s operational and strategic landscape. This understanding helps in diagnosing inefficiencies, designing targeted interventions, or assessing investment opportunities.

The detailed breakdown of activities—from property development to disposition—serves as a diagnostic tool to evaluate a company’s core competencies and value drivers. It also aids in benchmarking against industry best practices or competitors by mapping each activity’s contribution to overall margins. This clarity supports strategic decision-making, whether optimizing existing processes or exploring new growth avenues.

For client executives, this slide simplifies complex industry processes into digestible segments, facilitating communication with stakeholders and investors. It supports discussions around operational improvements, risk management, and value creation strategies. The visual emphasis on margin generation underscores the financial impact of each activity, aligning operational priorities with profitability goals.

In consulting engagements, this slide functions as a foundational framework for conducting due diligence or strategic reviews. It helps teams quickly identify where value is most sensitive to change—such as leasing strategies or asset disposition—and prioritize initiatives accordingly. The support activities layer also highlights areas for potential operational enhancement or cost reduction, critical for improving margins in competitive markets.

How This Slide Is Used

This slide is typically used during strategic planning, operational diagnostics, or investment analysis within the CRE industry. It is often employed in client workshops to map out the existing value chain and identify gaps or inefficiencies. For example, a client looking to improve asset management might focus on the “Property Management” activity, assessing how to increase revenue or reduce costs.

In due diligence processes, this slide helps investors or acquirers understand the key value drivers and support functions that influence overall profitability. It provides a structured approach to evaluating how a target company’s activities align with industry standards and where potential improvements can be made. This is especially useful in M&A scenarios where operational synergies are a focus.

Management consultants leverage this framework to develop strategic roadmaps for clients aiming to optimize their CRE portfolios. They may analyze each activity’s contribution to margin, then recommend process improvements, technology investments, or organizational changes. The visual layout supports clear communication of complex operational concepts to executive teams.

In portfolio management, this slide guides ongoing performance tracking and resource allocation. Asset managers and property operators use it to identify high-impact areas for intervention, such as leasing strategies or disposition timing. It also serves as a reference point for aligning operational initiatives with financial targets, ensuring that each activity contributes effectively to margin enhancement.

Related PPT Slides

This slide presents a SWOT analysis focused on the commercial real estate (CRE) sector, highlighting key strengths, weaknesses, opportunities, and threats. It provides a structured snapshot of the sector's internal and external factors influencing asset performance, tailored for strategic decision-making by executives and investors.

Digital Transformation Levers Overview

This slide illustrates the key levers within a digital transformation strategy, emphasizing growth drivers and operational improvements. It categorizes eight specific levers under 2 main themes—growth and operational efficiency—and highlights their role in enabling business driver and enabler levers. The visual structure supports quick comprehension of how these elements interconnect to support transformation goals.

Logistics Value Chain Breakdown

This slide maps the core activities within a logistics value chain, highlighting how various functions contribute to transportation efficiency and customer service. It emphasizes the supporting activities that enable primary logistics operations, illustrating their role in cost management and service delivery. The visual structure offers a clear view of the interconnected processes essential for logistics performance.

This slide depicts the core activities and support functions within the mining industry, illustrating how value is generated from exploration through sales and trading. It emphasizes the importance of both primary operations and supporting activities, highlighting the flow of value creation and margin accumulation across the chain. The visual layout aids in understanding the interconnectedness of each stage and its contribution to overall profitability.

Michael Porter's Value Chain Diagram

This slide illustrates a modified version of Michael Porter's value chain framework, adapted to various organizations and industries. It categorizes activities into primary and support functions, providing a visual representation of how value is created and margin is generated through interconnected processes.

AgriTech Value Chain Breakdown

This slide illustrates the comprehensive value chain of the AgriTech industry, highlighting core activities from R&D to support services. It emphasizes the integration of primary functions such as innovation, manufacturing, distribution, and implementation, alongside support activities like data analytics and partnerships, all aimed at driving industry margins and growth.

Explore Slides by Tags

View Full Commercial Real Estate (CRE) PPT

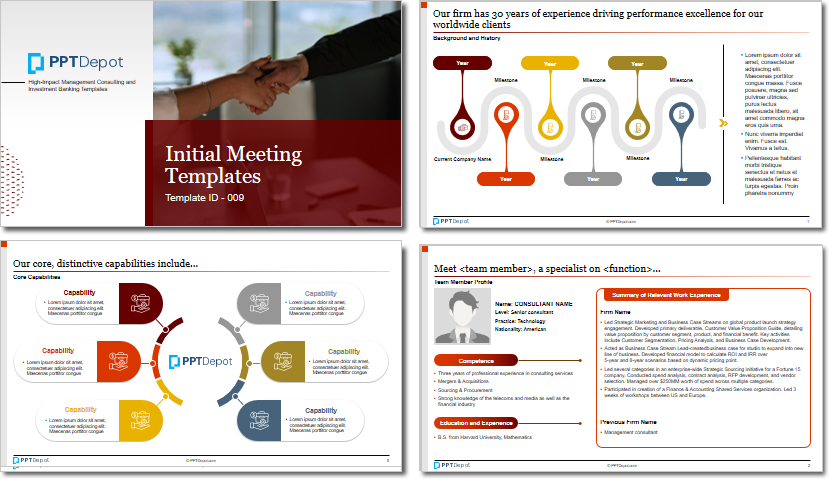

Download our FREE collection of over 50+ high-impact, fully editable PowerPoint templates. These professional templates cover a comprehensive range of strategic analysis frameworks—including Strategy Formulation, Innovation, Digital Transformation, Change Management, and many others—ideal for Management Consultants, Investment Bankers, Strategy Professionals, and Business Executives.

Trusted by Leading Global Organizations

Our templates are trusted by thousands of organizations worldwide, including leading brands such as those listed below.

Related Templates from PPT Depot

Leverage our domain and design expertise. Become a subscriber today:

Each presentation is available in 3 color schemes. Download the version that most fits your firm's branding and customize it further once you download the PPTX file.

PPT Depot is your subscription to high-impact management consulting and investment banking templates—crafted from real-world deliverables by ex-MBB consultants and designed by former McKinsey Visual Graphics (VGI) presentation specialists. Compare plans here to determine what's the best fit for your firm.

With 15 years of experience, the team behind PPT Depot has empowered over 500+ clients across over 30+ countries. We currently produce 200,000 slides annually.

PPT Depot releases new templates each week. We have management topic-focused templates (e.g. market analysis, strategic planning, digital transformation, and more), alongside industry-specific collections. Peruse our full inventory here.

Save time and effort—elevate your presentations with proven domain and design expertise.

Got a question? Email us at [email protected].

Related Consulting Presentations

These presentations below are available for individual purchase from Flevy , the marketplace for business best practices.

Slide Customization & Production

We provide tailored slide customization and production services:

- Conversion of scanned notes into PowerPoint slides

- Development of PowerPoint master template

- Creation of data-driven PowerPoint charts from hand-drawn graphs

- Conversion of Excel charts to PowerPoint charts

- Conversion of other file formats (e.g. PDF, TIF, Word Doc) to PowerPoint slides

- Conversion of PowerPoint slides from one master template to another

- Visual enhancement of existing PowerPoint presentations to increase the professional look of the presentation