Why This Slide Is Useful

This slide is valuable for senior executives and strategic planners assessing sector-specific growth opportunities. It distills complex market dynamics into a clear, visual format that underscores the importance of industrial, multifamily, and data centers in driving CRE expansion. For investors or corporate real estate teams, understanding these verticals helps prioritize resource allocation and develop targeted strategies aligned with evolving tenant demands.

The slide’s focus on tenant needs—such as high vacancy challenges in office spaces, retail growth rates, or logistics in industrial properties—provides actionable insights. It enables decision-makers to identify which segments are most resilient or poised for expansion, guiding capital deployment or operational focus. The concise data points serve as a quick reference for evaluating sector health and growth potential.

Additionally, this slide supports strategic conversations around portfolio diversification or new development opportunities. It highlights the segments that are currently outperforming or experiencing cyclical growth, which can influence investment timing or partnership strategies. Overall, it acts as a foundational reference for sector-specific market intelligence in CRE planning and execution.

How This Slide Is Used

This slide is typically used in market assessment, investment thesis development, or portfolio review sessions. Real estate investors and corporate strategists leverage it to identify high-growth segments within CRE and align their initiatives accordingly. For example, an institutional investor might use this slide to decide whether to increase exposure to data centers or multifamily assets based on recent growth trends and tenant demand.

In strategic planning meetings, teams analyze the relative performance of each vertical to determine where to focus development or acquisition efforts. The slide’s visual format makes it easy to communicate sector priorities to stakeholders, including board members or external partners. It also serves as a reference point during quarterly reviews or market updates, providing a quick snapshot of sector health.

Consultants working with real estate firms or corporate clients often customize this slide by adding regional or sub-sector details. For instance, they might overlay geographic data to identify markets where industrial or multifamily growth is most pronounced. This helps tailor investment strategies or operational plans to specific market conditions.

In due diligence processes, this slide supports scenario analysis by illustrating how tenant demands and growth drivers vary across CRE verticals. It helps teams evaluate risks and opportunities associated with each segment, informing decisions on asset management, development, or divestment. The clarity and focus of this slide make it a versatile tool for multiple stages of CRE strategy development.

Related PPT Slides

Major AgriTech Verticals Overview

This slide highlights key segments within the AgriTech industry, emphasizing their distinct growth trajectories and challenges. It details 4 major verticals—Precision Agriculture, Agricultural Biotechnology, Farm Management Software, and Agricultural Robotics—each supported by specific technological innovations and market dynamics. The visual layout combines imagery and concise descriptions to inform strategic discussions around industry segmentation and investment focus.

Automotive and Electronics Growth Trends

This slide highlights the key verticals driving growth in the automotive, electronics, and healthcare sectors, emphasizing their market dynamics and projected expansion. It categorizes these industries into specific segments, providing concise data points and growth drivers relevant for strategic assessment and investment considerations.

This slide provides an overview of the commercial real estate (CRE) industry, highlighting key market statistics and emerging trends. It emphasizes the sector's evolving landscape driven by hybrid work, sustainability efforts, and technological advancements, supported by relevant data points and strategic themes for investors and industry leaders.

ADL Matrix for Portfolio Strategy

This slide illustrates the ADL matrix, a framework used to evaluate portfolio units based on industry maturity and competitive position. It categorizes units into 4 industry stages—Embryonic, Growth, Mature, and Aging—and 5 competitive positions, from Weak to Dominant, providing a visual tool for strategic decision-making at the portfolio level.

Post-COVID CRE Market Dynamics

This slide analyzes the competitive landscape of the commercial real estate (CRE) market following the COVID pandemic. It highlights key industry threats, bargaining power shifts among buyers and suppliers, and emerging substitution risks, providing a structured view of the evolving market forces impacting tenant leverage and investment strategies.

This slide outlines the key drivers and enablers of digital transformation, emphasizing the strategic linkage between growth initiatives and operational improvements. It visually categorizes eight specific levers under 2 main themes—growth drivers and operational enablers—highlighting their role in executing a comprehensive digital strategy for business growth and efficiency.

Explore Slides by Tags

View Full Commercial Real Estate (CRE) PPT

Download our FREE collection of over 50+ high-impact, fully editable PowerPoint templates. These professional templates cover a comprehensive range of strategic analysis frameworks—including Strategy Formulation, Innovation, Digital Transformation, Change Management, and many others—ideal for Management Consultants, Investment Bankers, Strategy Professionals, and Business Executives.

Trusted by Leading Global Organizations

Our templates are trusted by thousands of organizations worldwide, including leading brands such as those listed below.

Related Templates from PPT Depot

Leverage our domain and design expertise. Become a subscriber today:

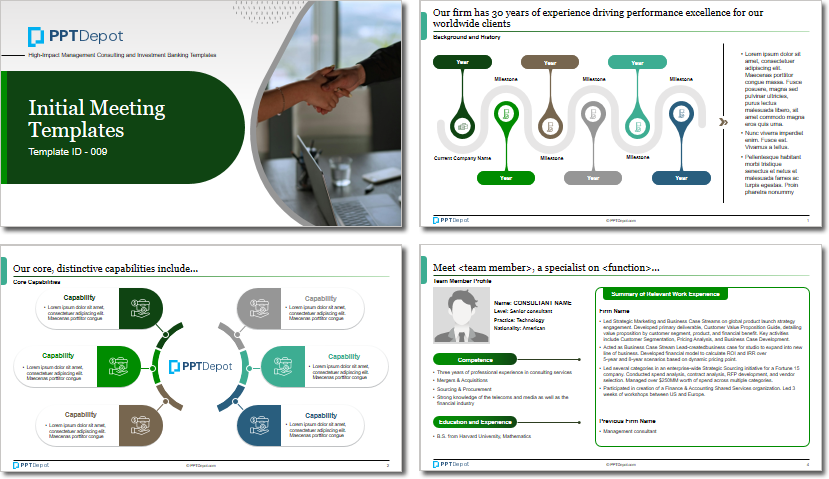

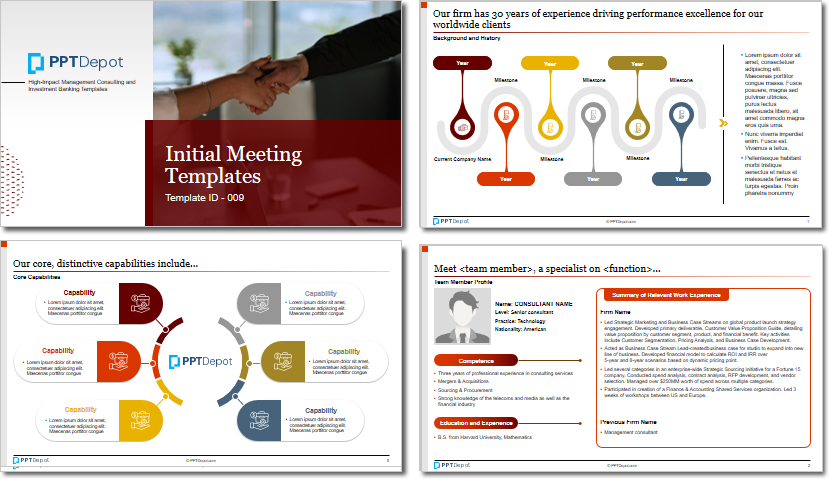

Each presentation is available in 3 color schemes. Download the version that most fits your firm's branding and customize it further once you download the PPTX file.

PPT Depot is your subscription to high-impact management consulting and investment banking templates—crafted from real-world deliverables by ex-MBB consultants and designed by former McKinsey Visual Graphics (VGI) presentation specialists. Compare plans here to determine what's the best fit for your firm.

With 15 years of experience, the team behind PPT Depot has empowered over 500+ clients across over 30+ countries. We currently produce 200,000 slides annually.

PPT Depot releases new templates each week. We have management topic-focused templates (e.g. market analysis, strategic planning, digital transformation, and more), alongside industry-specific collections. Peruse our full inventory here.

Save time and effort—elevate your presentations with proven domain and design expertise.

Got a question? Email us at [email protected].

Related Consulting Presentations

These presentations below are available for individual purchase from Flevy , the marketplace for business best practices.

Slide Customization & Production

We provide tailored slide customization and production services:

- Conversion of scanned notes into PowerPoint slides

- Development of PowerPoint master template

- Creation of data-driven PowerPoint charts from hand-drawn graphs

- Conversion of Excel charts to PowerPoint charts

- Conversion of other file formats (e.g. PDF, TIF, Word Doc) to PowerPoint slides

- Conversion of PowerPoint slides from one master template to another

- Visual enhancement of existing PowerPoint presentations to increase the professional look of the presentation