Why This Slide Is Useful

This slide is valuable for senior executives, strategy consultants, and investors focused on CRE markets. It consolidates critical external drivers that impact investment returns and operational risks, enabling informed planning and risk mitigation. By understanding these factors, leadership can better align their strategies with evolving regulatory and market conditions, ensuring resilience and competitive positioning.

The categorization into 6 environmental areas offers a structured way to assess external influences systematically. For example, political incentives like tax benefits and zoning reforms directly affect development opportunities, while social trends such as urbanization demand adaptive asset management. Recognizing these drivers helps executives prioritize initiatives and allocate resources effectively.

Legal and environmental considerations are increasingly integral to CRE strategies, especially with rising ESG mandates and climate risks. This slide emphasizes the importance of compliance and sustainability efforts, which are now core to value creation and risk management. It also signals the need for ongoing monitoring of regulatory changes to avoid compliance pitfalls and capitalize on emerging opportunities.

Overall, this slide acts as a strategic compass, guiding decision-makers through complex external factors. It supports scenario planning and stress testing, especially in volatile environments where regulatory and market shifts can rapidly alter investment viability. For PE firms and institutional investors, it provides a framework to evaluate macro risks and opportunities in CRE portfolios.

How This Slide Is Used

This slide is typically used in strategic planning sessions, market entry assessments, or portfolio reviews. Investment teams rely on it to identify external risks and opportunities that could influence asset performance or acquisition decisions. It serves as a foundation for developing risk mitigation strategies aligned with external drivers.

In due diligence processes, this slide helps investors understand the regulatory and environmental landscape impacting target assets. For instance, a firm evaluating a property in a region with upcoming zoning reforms or climate risks would use this analysis to adjust valuation assumptions or develop contingency plans.

Consultants often customize this framework to client-specific contexts, overlaying market data or scenario analyses. For example, they might simulate the impact of a new ESG regulation or climate event on a portfolio’s cash flows, using this environmental overview as a baseline.

In ongoing asset management, this slide supports monitoring efforts. Teams track changes in political incentives, legal requirements, or environmental risks, updating strategies accordingly. It also facilitates stakeholder communication, providing a clear, visual summary of external factors shaping CRE investment and operations.

Related PPT Slides

Global Chemicals Market Environmental Factors

This slide provides an analysis of political, economic, social, technological, legal, and environmental factors shaping strategies within the global chemicals industry. It highlights key trends and regulatory considerations that influence market dynamics and corporate decision-making across different regions and segments.

PESTLE External Factors Analysis

This slide illustrates the PESTLE framework, a tool used to evaluate external macro-environmental factors impacting an industry or organization. It categorizes influences into 6 areas—Political, Economic, Social, Technological, Legal, and Environmental—each represented by a segment around a central PESTLE label, with space for key insights under each category.

EdTech Strategies and Market Drivers

This slide outlines the key political, economic, social, technological, legal, and environmental factors shaping EdTech strategies, compliance, and market adoption. It highlights specific trends and regulatory impacts across these dimensions, providing a comprehensive view of the external environment influencing the sector. The information is structured to support strategic decision-making at the executive level.

PEST Environmental Analysis Framework

This slide introduces the PEST framework, a tool used to evaluate the external macro-environmental factors influencing an organization. It segments these factors into 4 categories—Political, Economic, Social, and Technological—each represented with a dedicated column and bullet points for key considerations. The layout provides a clear, structured view suitable for strategic assessments.

Extended STEEPLE Environmental Analysis

This slide illustrates the STEEPLE framework, which broadens the traditional PEST analysis by incorporating legal and ethical considerations. It segments the external environment into 7 categories—Social, Technological, Economic, Environmental, Political, Legal, and Ethical—each with space for detailed bullet points, enabling comprehensive environmental scanning for strategic decision-making.

Robotics Market Forces Overview

This slide analyzes the multifaceted influences shaping the robotics industry, segmented into political, economic, social, technological, legal, and environmental factors. It highlights key regulatory, financial, workforce, technological, legal, and ecological trends that collectively impact robotics market strategies and growth potential. The structured format offers a comprehensive view for executives assessing industry risks and opportunities.

Explore Slides by Tags

View Full Commercial Real Estate (CRE) PPT

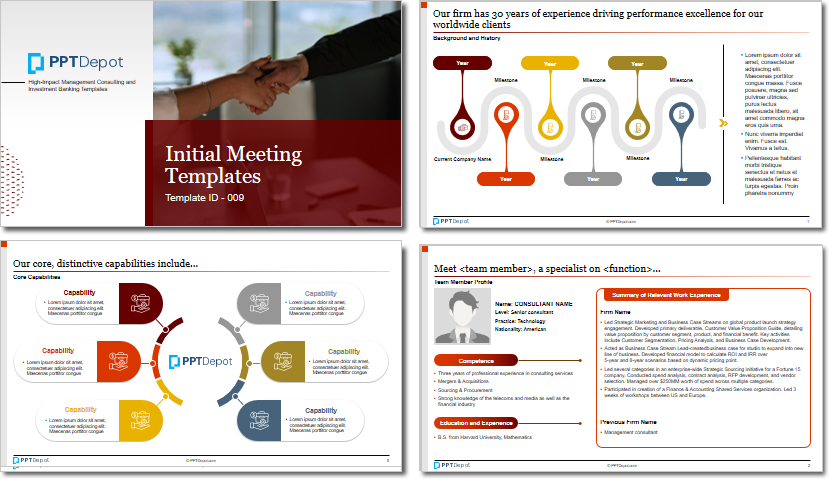

Download our FREE collection of over 50+ high-impact, fully editable PowerPoint templates. These professional templates cover a comprehensive range of strategic analysis frameworks—including Strategy Formulation, Innovation, Digital Transformation, Change Management, and many others—ideal for Management Consultants, Investment Bankers, Strategy Professionals, and Business Executives.

Trusted by Leading Global Organizations

Our templates are trusted by thousands of organizations worldwide, including leading brands such as those listed below.

Related Templates from PPT Depot

Leverage our domain and design expertise. Become a subscriber today:

Each presentation is available in 3 color schemes. Download the version that most fits your firm's branding and customize it further once you download the PPTX file.

PPT Depot is your subscription to high-impact management consulting and investment banking templates—crafted from real-world deliverables by ex-MBB consultants and designed by former McKinsey Visual Graphics (VGI) presentation specialists. Compare plans here to determine what's the best fit for your firm.

With 15 years of experience, the team behind PPT Depot has empowered over 500+ clients across over 30+ countries. We currently produce 200,000 slides annually.

PPT Depot releases new templates each week. We have management topic-focused templates (e.g. market analysis, strategic planning, digital transformation, and more), alongside industry-specific collections. Peruse our full inventory here.

Save time and effort—elevate your presentations with proven domain and design expertise.

Got a question? Email us at [email protected].

Related Consulting Presentations

These presentations below are available for individual purchase from Flevy , the marketplace for business best practices.

Slide Customization & Production

We provide tailored slide customization and production services:

- Conversion of scanned notes into PowerPoint slides

- Development of PowerPoint master template

- Creation of data-driven PowerPoint charts from hand-drawn graphs

- Conversion of Excel charts to PowerPoint charts

- Conversion of other file formats (e.g. PDF, TIF, Word Doc) to PowerPoint slides

- Conversion of PowerPoint slides from one master template to another

- Visual enhancement of existing PowerPoint presentations to increase the professional look of the presentation